On May 3, 2023, the Canadian Parliament made an announcement regarding the passage of Bill S-211, an Act to implement the “Fighting Against Forced Labour and Child Labour in Supply Chains Act”. If it receives royal assent in 2023, the Act will come into effect on January 1, 2024, which will require initial reports for the Act to be submitted no later than May 31, 2024.

This newly enacted legislation sets forth a comprehensive reporting structure to combat and diminish the risks associated with forced labour and child labour in supply chains, carrying immediate ramifications for Canadian businesses, importers, and various Canadian governmental institutions.

What Businesses Are Impacted By Bill S-211?

The reporting obligations under the new Forced Labour in Supply Chains Act impact all Canadian federal government institutions, departments, Crown corporations and their subsidiaries, and any private sector company that meets the following criteria:

-

- Is engaged in the production, sale, or distribution of goods within Canada or abroad.

- Imports goods that are produced outside of Canada.

Oversees an “entity” involved in either of the above activities. Currently, the term “entity” is defined as corporations, trusts, partnerships, or other unincorporated organizations that are listed on the stock exchange in Canada or have a place of business, conduct business, or possess assets in Canada, and satisfy at least two of the following conditions for at least one of it’s two most recent financial years:

- Generates at least C$40 million in revenue.

- Employs an average of at least 250 employees.

What Are Business Impacted By Bill S-211 Required To Report?

Once enacted, by May 31st of each year, impacted entities must submit a report to the Minister detailing the actions taken during the previous financial year to prevent and reduce the risk of forced labor or child labor in the production of goods. This includes the organization’s own production processes in Canada or elsewhere, as well as goods imported into Canada by the organization.

Single or Joint Reporting

An organization can fulfill this requirement by a) providing a report specifically for itself or b) submitting a joint report that covers multiple entities.

The following key information must be included in the final report:

- Details about the organization’s structure, activities, and supply chains.

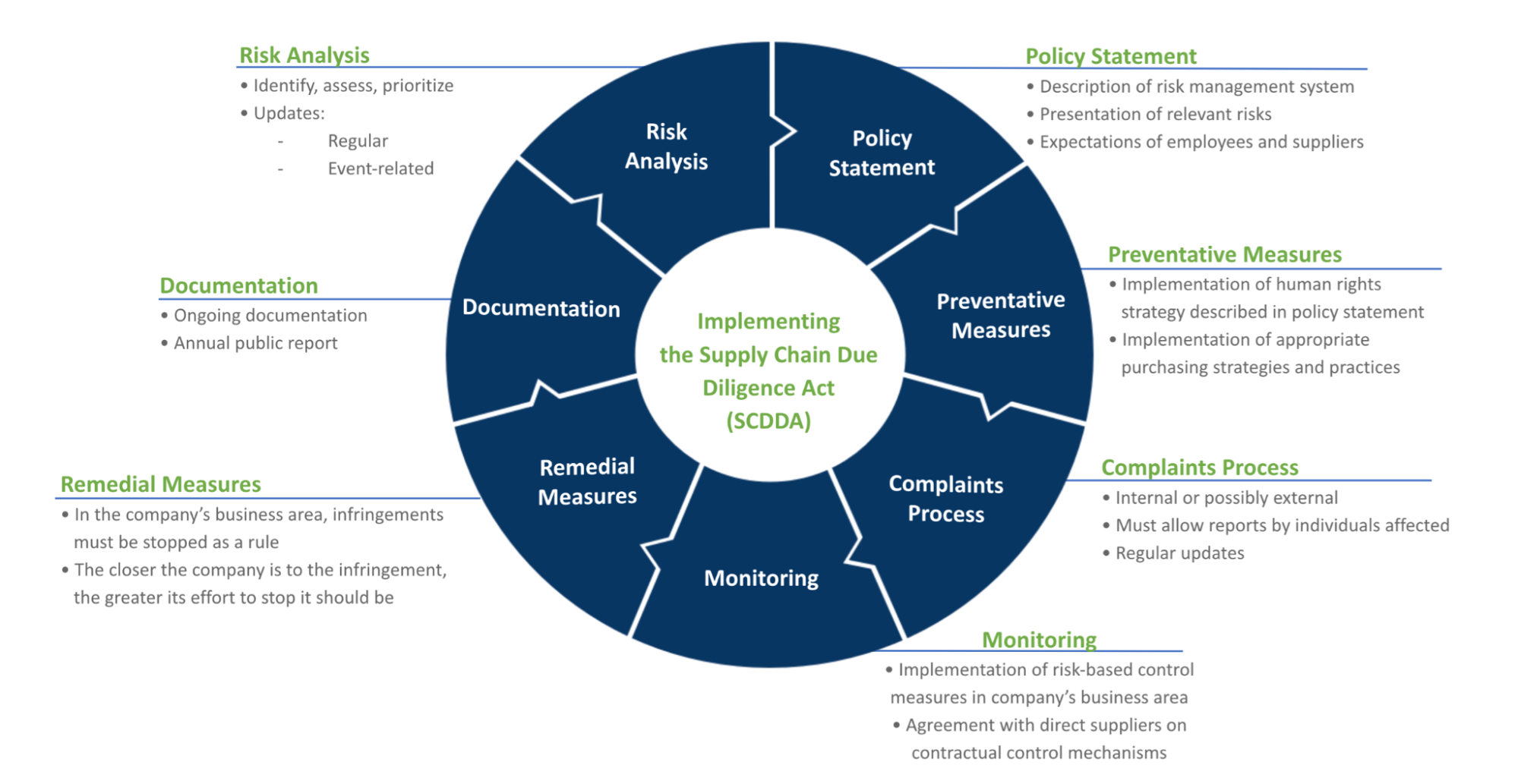

- An outline of the policies and due diligence processes in place to address forced labor and child labor.

- Identified parts of the business and supply chains that pose risks, and steps taken to assess and manage those risks.

- Any measures taken to address forced labor or child labor, as well as any efforts to mitigate the impact on vulnerable families.

- An overview of the training provided to employees on these issues.

- An assessment of the organization’s effectiveness in addressing forced labor and child labor.

Bill S-211 Enforcement

Non-compliance with the Fighting Against Forced Labour and Child Labour in Supply Chains Act, including failure to prepare or make a report available, failure to assist or obstruct an investigation, or failure to comply with a corrective order, is considered an offense. Knowingly providing false or misleading information to the minister or one of the minister’s designates, or intentionally making false or misleading statements, also constitutes an offense. And any officer or director of an individual found failing to comply will also be held equally guilty of the offense. Any person or entity found guilty of the outlined offenses is liable to a fine of up to $250,000.

Customs Tariff Amendment

Bill S-211 brings amendments to the Customs Tariff, expanding its scope to also prohibit goods mined, manufactured, or produced partially or entirely through forced labour or child labour from being imported.

How ESG Playbook Can Help With Bill S-211 Reporting

ESG Playbook is the premier destination for comprehensive sustainability reporting. Our platform supports ESG reporting, ensuring seamless regulatory compliance. Gain access to streamlined data collection, intuitive project management, and pre-built templates. Showcase your commitment to sustainability with our audit-ready solutions.

With 10+ reporting tools for public and private companies, our platform offers frameworks like SASB/ISSB, GRI, TCFD, CDP, UN SDGs, WEF, and regulations including EU Taxonomy, SFDR, and CSRD. From regulatory reporting to carbon reduction strategies and supply chain due diligence, our tools establish an efficient approach to sustainability and ESG reporting.

Website:

www.esgplaybook.com