Are you selling financial products in the European Union?

If so, you are subject to the SFDR Regulatory Technical Standards (RTS) which went live on January 1st, 2023. This document will help you understand the regulations and how your organization can fully comply with the new requirements.

What is the SFDR?

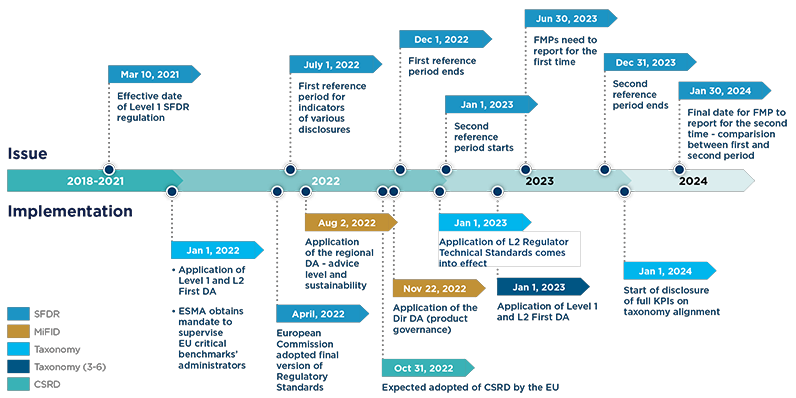

Sustainable Finance Disclosure Regulation (SFDR) is a European regulation introduced on March 10, 2021. It is an important pillar of the EU action plan on financing sustainable growth. SFDR aims to improve transparency in the market for sustainable investment products, prevent greenwashing and increase transparency around sustainability claims made by financial market participants. Under SFDR, Financial Market Participants (FMPs) and financial products are subject to different disclosure requirements.

There are two levels under SFDR: Level 1 and Level 2. SFDR level 1 requires financial institutions within the EU to make principles-based disclosures on sustainability-related information. SFDR level 2 includes more quantitative measures under the SFDR Level 2 RTS. The European Commission (EC) officially adopted the RTS proposed by the three European Supervisory Authorities (EBA, EIOPA and ESMA – ESAs) on 6 April 2022. Following that, the ESAs delivered their Final Report with draft RTS to include fossil gas and nuclear energy activities into the disclosure on 30 September 2022. The draft is still awaiting approval by the European Parliament and the Council, with an earliest application date in the beginning of February 2023.

Who and which types of products does the SFDR apply to?

The scope of the EU SFDR is broad, applying to all financial market participants (FMPs) based in the EU, as well as those registered outside of the EU, who market (or intend to market) their financial products to clients in the EU. Asset managers, banks, insurance companies, investment firms, pension funds and financial advisors are impacted by SFDR.

In terms of financial products, the disclosures regime applies to UCITS, AIFs, Insurance-based investment products, separately-managed portfolios and sub-advisory mandates, as well as to financial advice (provided within the EU or by an EU investment firm).

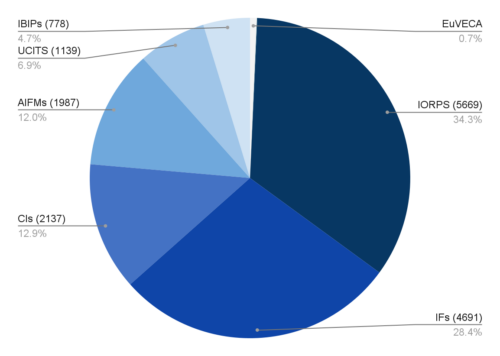

Specifically, larger FMPs (having more than 500 employees) and FMPs who choose to consider the Principal Adverse Impacts (PAI) are required to disclose PAI statements with reporting due on June 30 each year with data covering the previous reporting year. FMPs below the threshold can opt to ‘Comply or Explain’ the reasons why they do not consider PAI. Based on the European Commission’s study, over 14,000 FMPs are impacted by SFDR.

Source: European Commission

Who and which types of products does the SFDR apply to?

The time for SFDR reporting is now. From 1 January 2023, FMPs need to start disclosing the sustainability related information in the product prospectus and annual reports using the templates stipulated by Level 2 RTS. The first PAI statement with quantitative data covering the first reference period from 1 January to 31 December 2022 is due by 30 June 2023. Lastly, financial products are required to comply with SFDR Article 7 from 30 December 2022.

In terms of financial products, the disclosures regime applies to UCITS, AIFs, Insurance-based investment products, separately-managed portfolios and sub-advisory mandates, as well as to financial advice (provided within the EU or by an EU investment firm).

Specifically, larger FMPs (having more than 500 employees) and FMPs who choose to consider the Principal Adverse Impacts (PAI) are required to disclose PAI statements with reporting due on June 30 each year with data covering the previous reporting year. FMPs below the threshold can opt to ‘Comply or Explain’ the reasons why they do not consider PAI. Based on the European Commission’s study, over 14,000 FMPs are impacted by SFDR.

What are sustainability risks and principal adverse impacts (PAI)?

The EU SFDR requires specific entity-level disclosures from FMPs regarding how they address two key considerations: sustainability risks and principal adverse impacts (PAI) under Articles 3, 4 and 5. With regards to FMPs, the EU SFDR also mandates transparency of remuneration policies in relation to the integration of sustainability risks. Sustainability risks and principal adverse impacts are defined as follows:

In terms of financial products, the disclosures regime applies to UCITS, AIFs, Insurance-based investment products, separately-managed portfolios and sub-advisory mandates, as well as to financial advice (provided within the EU or by an EU investment firm).

Specifically, larger FMPs (having more than 500 employees) and FMPs who choose to consider the Principal Adverse Impacts (PAI) are required to disclose PAI statements with reporting due on June 30 each year with data covering the previous reporting year. FMPs below the threshold can opt to ‘Comply or Explain’ the reasons why they do not consider PAI. Based on the European Commission’s study, over 14,000 FMPs are impacted by SFDR.

- Sustainability Risks refer to environmental, social or governance events, or conditions, such as climate change, which could cause an actual or a potential material negative impact on the value of an investment.

- Principal Adverse Impacts are any negative effects that investment decisions or advice could have on sustainability factors. Examples could include investing in a company with business operations that significantly contribute to carbon dioxide emissions.

FMPs are required to break out how they consider Principal Adverse Impacts into more specific and quantifiable detail, with reference to indicators related to climate and the environment, and indicators related to social and employee issues, respect for human rights, and anti-corruption and anti-bribery matters for all funds under SFDR.

Currently there are 64 PAI indicators, which are applicable to investee companies, real estate assets and sovereign bonds. The PAI indicators can be grouped into broader categories, such as greenhouse gas emissions, energy, biodiversity, waste, water, or human rights. There are 18 mandatory indicators and the remainder are voluntary indicators for 2022 reporting. FMPs must report on all applicable mandatory indicators and select at least one environmental indicator and one social indicator. The chart below shows a sample of mandatory indicators.

How is data aggregated to an entity level and a fund level?

FMPs are required to break out how they consider Principal Adverse Impacts into more specific and quantifiable detail, with reference to indicators related to climate and the environment, and indicators related to social and employee issues, respect for human rights, and anti-corruption and anti-bribery matters for all funds under SFDR.

Currently there are 64 PAI indicators, which are applicable to investee companies, real estate assets and sovereign bonds. The PAI indicators can be grouped into broader categories, such as greenhouse gas emissions, energy, biodiversity, waste, water, or human rights. There are 18 mandatory indicators and the remainder are voluntary indicators for 2022 reporting. FMPs must report on all applicable mandatory indicators and select at least one environmental indicator and one social indicator. The chart below shows a sample of mandatory indicators.

FMPs may hold thousands of investments and the share or value of holdings may change throughout the year. To capture the overall impact of the investments, the annual disclosure should be based on the arithmetic average of the attributed impacts of all the FMP’s investments (direct and indirect investments) at the end of each quarter, as laid out in Article 6(3) of the Delegated Regulation. Such annual disclosures should be based on the average of indicators observed on 31 March, 30 June, 30 September, and 31 December for any reference period.

However, in the latest FAQ published on 17 Nov 2022, ESAs clarified that FMPs should calculate all the impacts from the four data points at the same time. This calculation should be based on the latest available information on the impacts of the investee companies. Therefore, the provision of data by undertakings on a quarterly basis is not a prerequisite to perform at least four quarterly calculations.

Lastly, the aggregation methodology for each indicator varies. Some indicators use weighted average while others may use per million EUR invested. The average impacts are aggregated using the PAI indicators applicable to investee companies, real estate assets, sovereigns and supranationals.

What disclosures are needed if FMPs offer Article 8, 9 funds?

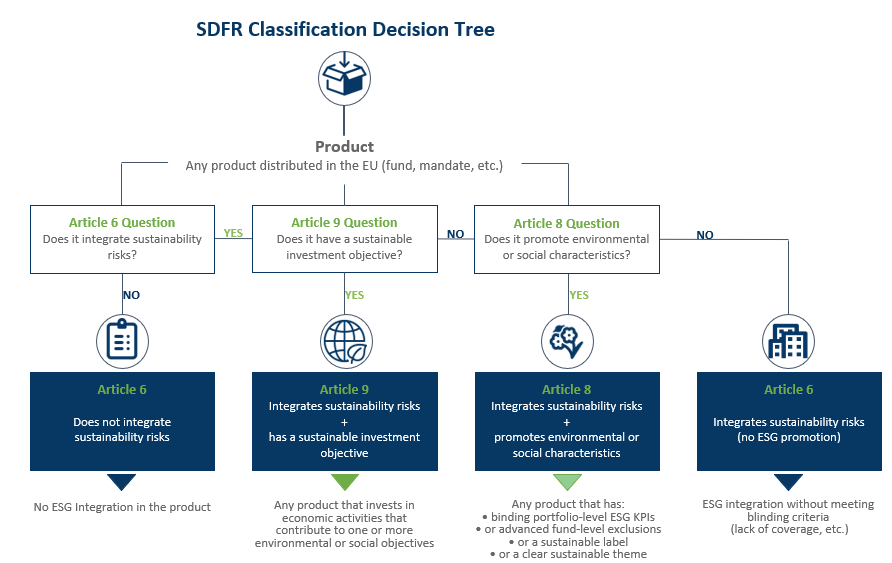

The EU SFDR aims to help investors to choose between products by mandating increasing levels of pre-contractual and periodic disclosures, depending on the degree to which sustainability is a consideration.

Funds are classified as Article 6, Article 8 or Article 9 funds based on sustainability characteristics. Article 6 fund only considers sustainability risk or may not and does not contain any binding ESG characteristics. Article 8 fund not only considers sustainability risk, but also promotes environmental or social characteristics, and follows good governance practices. The highest designation is Article 9 fund. It has a sustainable investment objective and should only make sustainable investments.

Funds that fall into the scope must disclose sustainability information in prospectus and annual reports using the templates stipulated in the RTS under Articles 7,8,9,10, and 11. To fulfill the fund-level requirements, FMPs will need to collect a large amount of data around sustainability factors, investment strategy, asset allocation, PAI, top investments, share of EU Taxonomy-aligned turnover, CapEx and OpEx, Do No Significant Harm, UNGC and OECD compliance, benchmark performance, and so on.

Funds are classified as Article 6, Article 8 or Article 9 funds based on sustainability characteristics. Article 6 fund only considers sustainability risk or may not and does not contain any binding ESG characteristics. Article 8 fund not only considers sustainability risk, but also promotes environmental or social characteristics, and follows good governance practices. The highest designation is Article 9 fund. It has a sustainable investment objective and should only make sustainable investments.

ESG Playbook has you covered.

Implementing the EU Taxonomy poses various challenges and high costs in both time and capital for companies and financial institutions who will need to create new systems and procedures for ensuring compliance. With a general lack of data relevant to reporting requirements, financial market players face a major roadblock in meeting EU Taxonomy requirements.

For investee companies, there are many data providers which have compiled the SFDR data. ESG Playbook has partnered with the top data vendors to streamline reporting on the PAI statements and periodic disclosure with APIs. Compliance and auditing capabilities have been built into the platform as well as guidance to aid in the reporting process. Data can be compared at the KPI level to compare data availability and reliability to enable you to produce a quality PAI report.

For data on private companies, there is very little data available. Data provider vendors generally are supplying estimates for private companies. So surveying the private companies and aggregating the data to the fund level will significantly increase the data coverage. Requesting the data and giving the portfolio companies time to compile the necessary KPIs will take time. However, ESG Playbook streamlines the data collection and aggregation with its survey manager. The survey manager compiles the data into the required formats for SFDR PAI reporting.

One of the main pieces of advice is simple: Act Now. Do not let perfection on methodologies or data be the enemy of progress. Aggregating the data and providing statements on the fund level is a complex and arduous task. The sooner you start, the better.

ESG Playbook Features for SFDR Reporting:

Use granular SFDR/EU Taxonomy aligned data directly from the companies in your portfolio to:

- Generate regulatory disclosure reports on a fund and entity level

- Ability to incorporate SFDR/EU Taxonomy data with multiple vendors

- Auto populate historical data to streamline the reporting process

- Collect data for private companies through survey manager

- Benchmark on a fund level and investee company level

- Manage the sustainability impact of your investments

- Automatically retrieve and disseminate your PAI reports

- Track actual versus estimate data for each of your KPIs

- Work with your compliance and audit teams with project management and verification tools built into the platform

- Periodic Disclosure and Precontractual templates with guidance

- Guidance on how to integrate Articles 6, 8 & 9 with your funds

We cohosted a SFDR webinar with Bloomberg on Feb 2nd, 2023. You can watch the recording on YouTube for free.