The Taskforce for Nature-related Financial Disclosures (TNFD) has released its ultimate recommendations concerning nature-related risk management and disclosure. Its objective is to offer a structured approach for organizations to navigate environmental risks and opportunities, ultimately directing capital towards constructive initiatives

What is the TNFD and what is it hoping to achieve?

The TNFD is a globally recognized initiative established in 2021 that extends the model established by the Taskforce on Climate-Related Financial Disclosures (TCFD), offering organizations a structured framework for managing risks and disclosing information related to evolving nature-related dependencies, impacts, risks, and opportunities. The recommendations aim to furnish capital providers and other stakeholders with information that is valuable for decision-making.

At present, corporations, investors, and financial institutions lack the necessary information to comprehend the influence of nature on an organization’s short-term and long-term financial performance. Additionally, there is a lack of data regarding an organization’s positive or negative contributions to nature and the subsequent long-term risks associated with these contributions.

Enhanced nature-related information can empower asset managers, financial institutions, and investors to gain a more comprehensive understanding of both immediate and long-term nature-related risks and opportunities. As regulatory pressures in the market continue to intensify, the hope is that investors will shift their capital away from businesses that have a detrimental impact on biodiversity, both directly and indirectly.

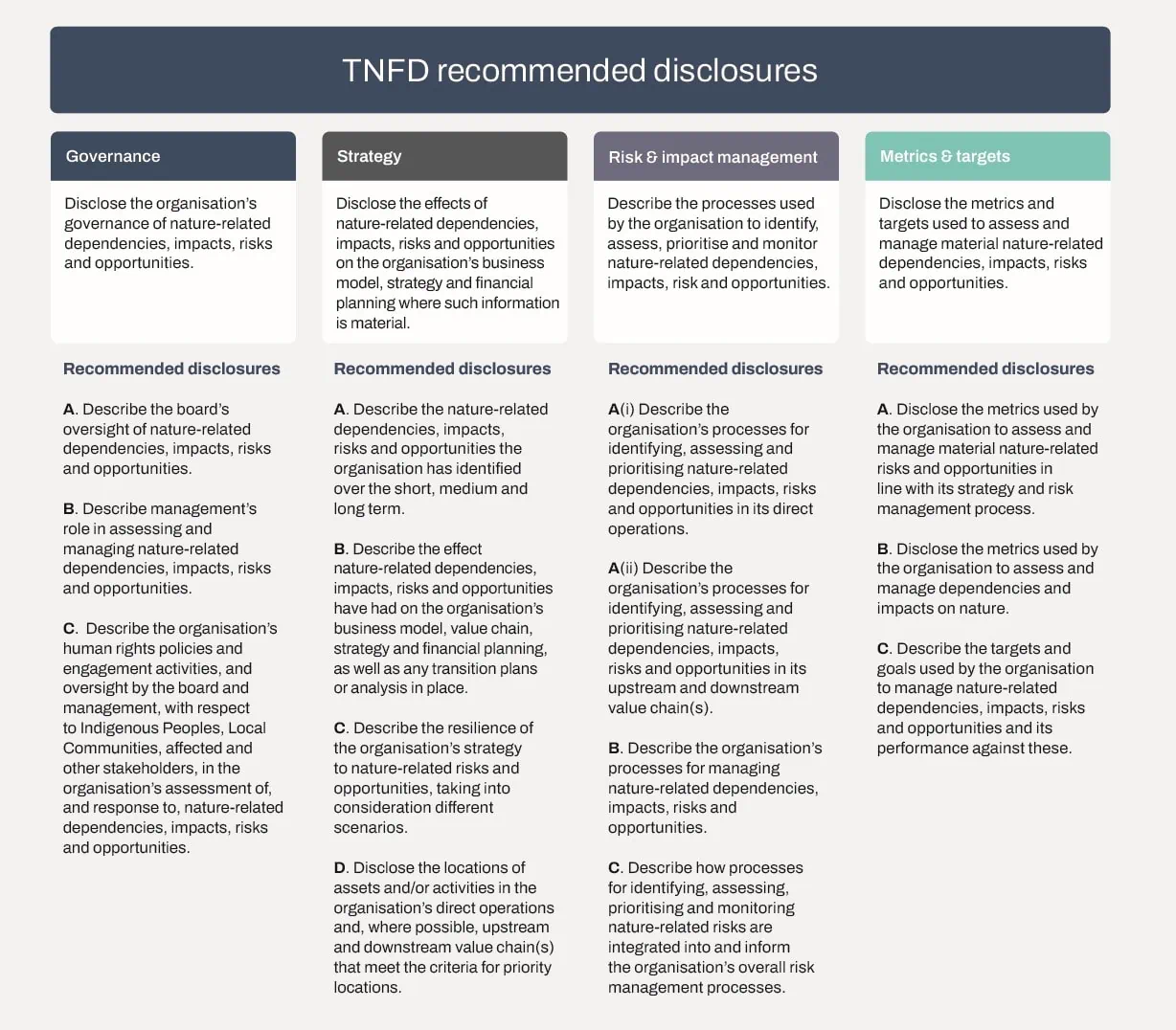

TNFD’s 4 pillars and corresponding recommended disclosures

The 14 recommendations outlined in the framework come after two years of design and development, and aim to mirror and enhance the objectives of the Task Force on Climate-related Financial Disclosures (TCFD) on which the ISSB standards have been built. They also follow the impact materiality approach adopted by the Global Reporting Initiative (GRI), which has been integrated into the new European Sustainability Reporting Standards (ESRS).

Over the past two years, the TNFD claims they have actively worked to harmonize their approach to remain in sync with the CSRD’s requirements. While other governments have expressed interest in the TNFD’s efforts, the decision to consider it as a mandatory option will ultimately fall on each individual member state.

The suggested disclosures follow the same four key pillars that structure the TCFD recommendations:

1) Governance

2) Strategy

3) Risk & Impact Management, and

4) Metrics & Targets.

The recommended disclosures are outlined by the TCFD below.

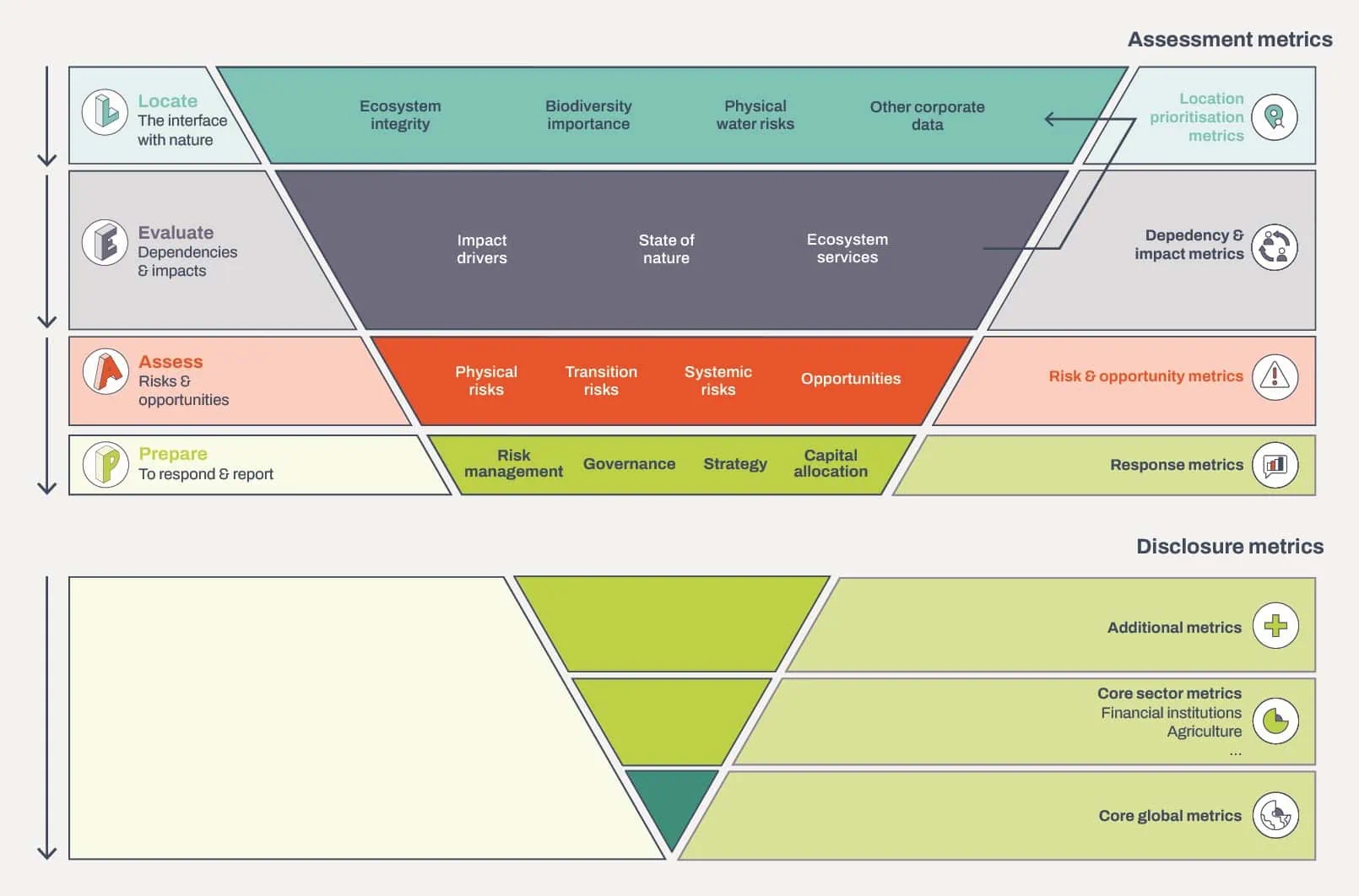

Disclosure metrics

The TNFD has outlined a smaller set of “core global metrics” applicable to all sectors and “core sector metrics” unique to each sector, which they have explained are to be “disclosed on a comply or explain basis”.

Additionally, the TNFD has also described a larger set of additional disclosure and assessment metrics, which preparers are able to use for their assessment and disclosure if they choose (see below).

Next steps for adoption

The TNFD is actively promoting and facilitating the voluntary adoption of these recommendations within the market. Drawing inspiration from the TCFD’s approach, the TNFD plans to monitor voluntary market adoption through an annual status update report, commencing in 2024.

ESG Playbook is the premier destination for comprehensive sustainability reporting. Our platform supports ESG reporting, ensuring seamless regulatory compliance.

Gain access to streamlined data collection, intuitive project management, and pre-built templates. Showcase your commitment to sustainability with our audit-ready solutions.

With 10+ reporting tools for public and private companies, our platform offers frameworks like SASB/ISSB, GRI, TCFD, CDP, UN SDGs, WEF, and regulations including EU Taxonomy, SFDR, and CSRD.

ESG Playbook will be adding the TNFD framework to our library of frameworks on our report builder, double materiality and our ESG Risk Manager.