The U.S. Securities and Exchange Commission’s (SEC) proposed ruling aims to enhance and standardize climate-related disclosures for investors in an effort to promote the importance of climate change risks and opportunities among public companies. This ruling, while originally meant to be disclosed in October 2022, is anticipated to be released shortly.

The proposed ruling is based upon two existing sustainable frameworks being the The Task Force on Climate-Related Financial Disclosures (TCFD) and The Greenhouse Gas (GHG) Protocol. The proposed mandate will require companies to report on how climate-related risks materially impact their business models, results of operations, financial condition, and the GHG emissions Scope 1, 2, and potentially scope 3. Scope 1 Direct Emissions pertains to a company’s owned and onsite emissions, Scope 2 Indirect Emissions relates to purchased electricity or other forms of energy for company facilities or vehicles, while Scope 3 Value Chain Emissions is indirect upstream and downstream activities. Additionally, the proposed ruling includes a company’s use of a carbon price, how they use a carbon price, and details about climate-related goals set by the companies, such as net-zero emissions targets.

In addition, the proposed ruling requires a registration statement and 10-K disclosure on climate risk management, governance and strategy with target and transition plans. Companies will then have to explain their strategy to achieve targets and transition plans.

While the SEC proposed ruling is still subject to change, currently, on a high level the following requirements are:

- Climate-related risks and their actual or likely material impacts on the registrant’s business, strategy, and outlook;

- The registrant’s governance of climate-related risks and relevant risk management processes;

- The registrant’s greenhouse gas (“GHG”) emissions, which, for accelerated and large accelerated filers and with respect to certain emissions, would be subject to assurance;

- Certain climate-related financial statement metrics and related disclosures in a note to its audited financial statements; and

- Information about climate-related targets and goals, and transition plan, if any.

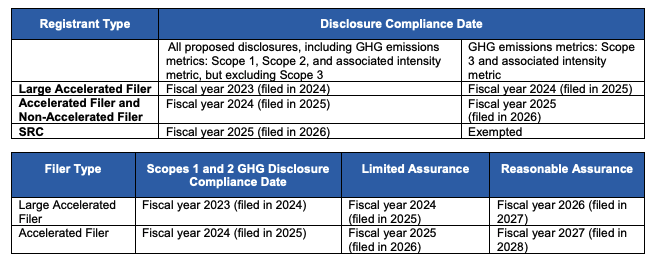

Phase-In Periods and Accommodations for the Proposed Disclosures

The proposed rules would include:

- A phase-in period for all registrants, with the compliance date dependent on the registrant’s filer status, and an additional phase-in period for Scope 3 emissions disclosure (see tables);

- A phase-in period for the assurance requirement and the level of assurance required for accelerated filers and large accelerated filers (see assurance table);

- A safe harbor for liability for Scope 3 emissions disclosure;

- An exemption from the Scope 3 emissions disclosure requirement for smaller reporting companies; and

- Forward-looking statement safe harbors pursuant to the Private Securities Litigation Reform Act, to the extent that proposed disclosures would include forward-looking statements.

Website: www.esgplaybook.com