Ready for a complete solution

Solutions Overview

Where do you start? Sustainability reporting, simplified for you.

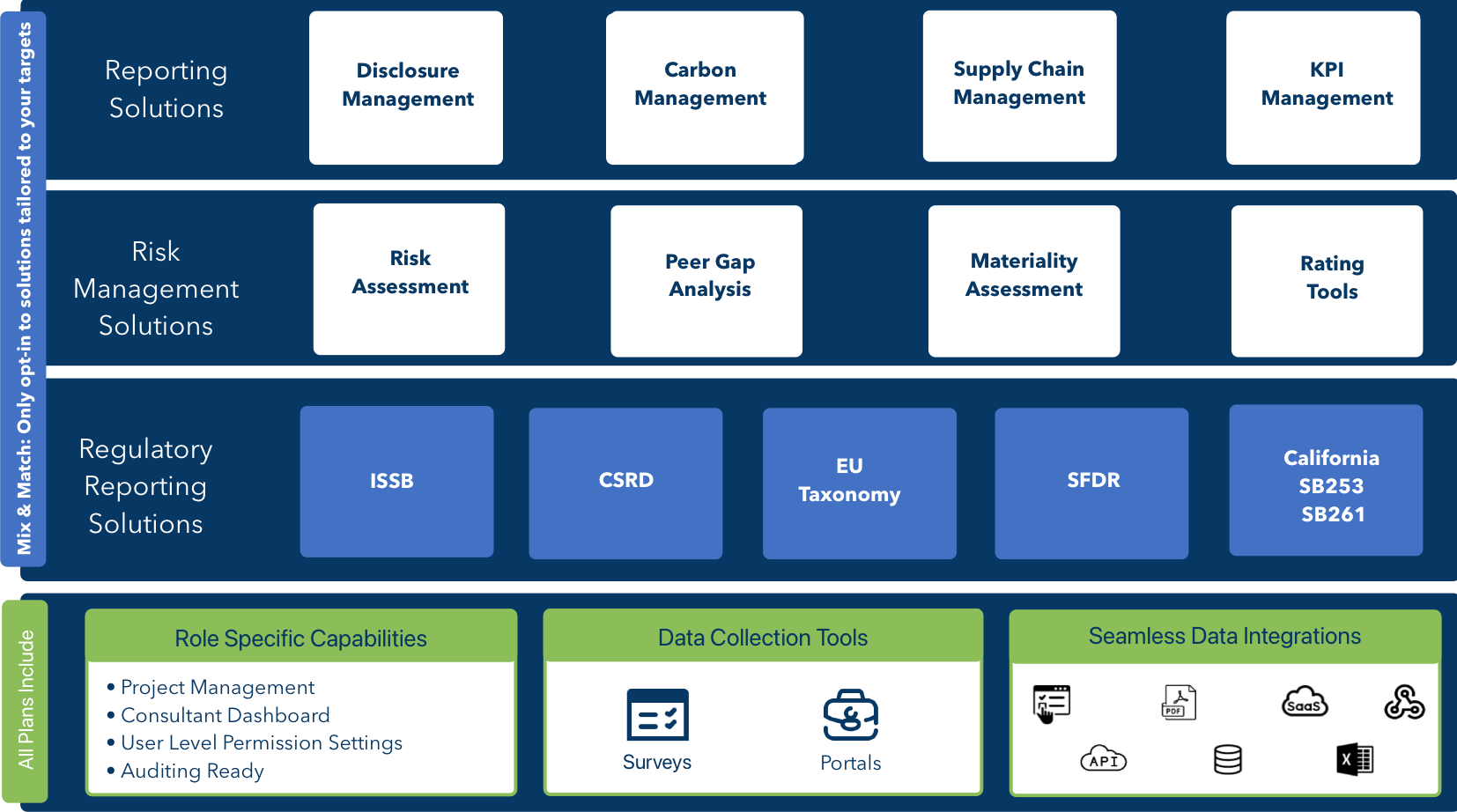

Our platform is built for flexibility, offering self-guided tools, step-by-step regulatory support, and seamless integration across reporting frameworks like CSRD, ISSB, EU Taxonomy, SFDR, and more.

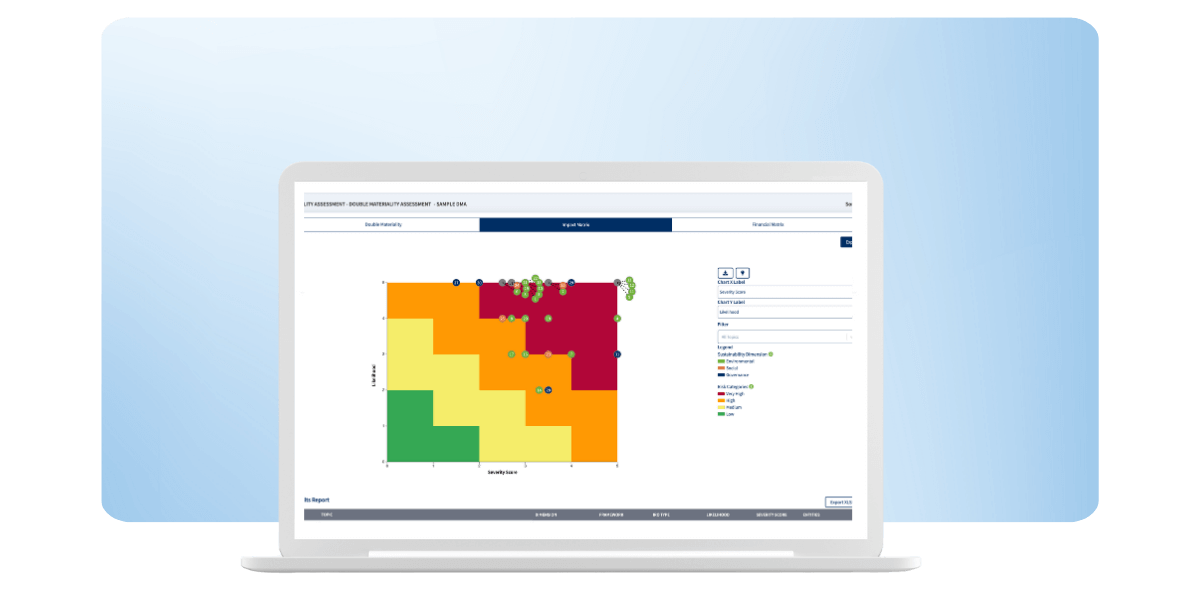

From carbon management and supplier reporting to KPI tracking, double materiality, and peer benchmarking…

Solutions

Corporate Disclosures Management

- Create your sustainability narrative

- In-depth step-by-step regulatory guidance

- Add and map multiple frameworks

- Policy, target and KPI gap analysis

- Auto-flow from Double Materiality to report

- Built-in project management tools

Carbon Emissions Management

- Scope 1, 2, 3 reporting with audit-ready data

- API imports, surveys, and email reminders for easy data collection

- Carbon heat maps modeling tools

- Supports ISSB, CSRD, EU Taxonomy, SFDR, and California laws

- Built-in project management tools

KPI Risk Management

- Manage your goals and track across frameworks

- GRI, SASB, TCFD, UN SDGs, EU Taxonomy SFDR and CSRD

- KPIs customizable to your strategy

- Industry-specific targets for planning

- Actionable insights and risk monitoring

- Built-in project management tools

Supply Chain Management

- Compliant with CSRD and CS3D regulations

- Centralized supplier portal with audits

- Risk scoring GRI, and SASB

- Aggregate Scope 3 emissions

- Modern Slavery due diligence for EU and global compliance

- Global mapping of suppliers and risks

One Platform

Comprehensive Sustainability Reporting. Simplified for you.

Included in every plan

Role Specific

- Project Management

- Consultant Dashboard

- User-level permission settings

- Audit ready

- Compliance built-in

Data Collection

- Surveys

- Portals

- API Integration

- Meter Integration

- Data Vendor Integration

Security & Privacy

-

SOC 2 Type 2 Certification

- Audit trails

- Azure

- Okta

- Data Privacy Framework (DPF)

ESG Playbook brings you tailored sustainability reporting for all

One platform

Centralizing emissions data across teams, locations and entities

Regulations built-in

Aligning carbon reporting in line with ISSB, GRI and CSRD regulation disclosures

Detailed analytics

Detailed insights across questionnaires, streamlining your reporting process

Audit-ready

Generating audit-ready, investor-grade sustainability reports

Scenario risk planning

Integrating climate risk scenario modeling and transition planning

Team collaboration

Team collaboration tools such as mass-assigning, goals tracking and status updates

Guided automation

Automated workflows and templates with step-by-step guidance

AI Copilot

Leverage AI copilot to aid you in your tailored disclosure narrative

Frameworks & Regulations

We support all the major frameworks

Our solutions support all the major frameworks and we provide the ability to mix and match elements across these frameworks. This enables our clients to create sustainability reports based on the unique needs of their organization.